Investing: Getting Started with The Fiscal Femme

In partnership with SoFi Invest.

For many, the stock market is a scary and intimidating place. And I get it. It was for me too. There are millions of articles and books, and even entire TV channels dedicated to talking about investing. There’s so much information out there and some of the jargon can be daunting and confusing (sometimes by design). No wonder we don’t feel like we know enough to get started!

To add to that, investing culture has historically been white and male-dominated. It can feel like investing is for the rich - the rich who work in finance (again, by design).

That’s a big problem because it keeps us from investing. And if we’re not investing, we’re potentially missing out on hundreds of thousands - if not millions - of dollars over the course of our lifetimes. Yes, I said millions. That’s NOT okay.

Why we need to invest.

To build wealth we can’t just save, we need to invest. We have to have our money grow and work for us. Why?

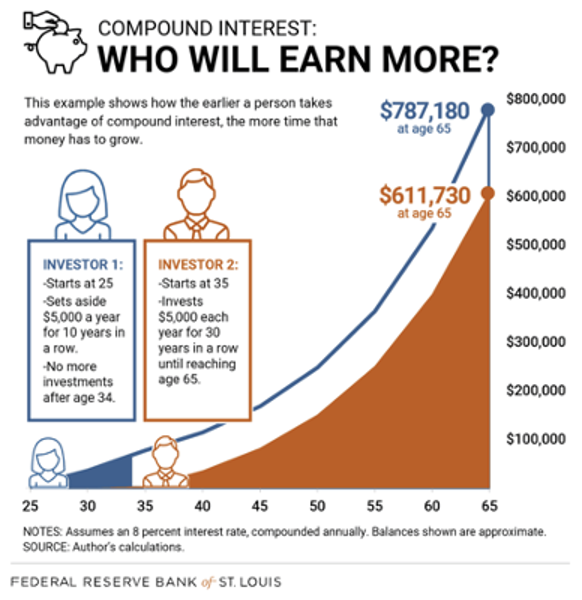

Compound interest. Compound interest is interest on interest. (Well, technically, dividends that compound when reinvested.) Given time, compound interest can make our investments and savings grow exponentially.

Diversification can help reduce some investment risk. However, it cannot guarantee profit nor fully protect in a down market.

This chart from the Federal Reserve Bank of St. Louis says it best.

Investor #1 invested a total of $50K compared with Investor #2 who invested a total of $150K (3x as much!).

Despite investing $100K less, Investor #1 ends up with $175K more (almost 30% more) than investor #2.

Just because she started ten years earlier.

Now Investor #3 isn’t on this chart but she’s a common one. She puts her cash in a high interest savings account (instead of investing) and earns 1%.

Okay, here’s another one.

Would you rather have a doubling penny for 30 days or $1,000,000?

I’m serious. Before you continue reading, make a choice. Which would you choose?

Drumroll… By day 30, the doubling penny would be worth almost $5.4 million dollars. That’s the power of compounding over time!

Who should be investing?

This is an important question. Before you start putting a significant portion of your savings towards investing, you might want to consider the following:

Have some rainy-day fund (to protect you from emergencies in the short term)

Maximize your 401(k) matching (which is investing). This is free money (or really a valuable part of your total compensation).

Pay down your high interest debt like credit cards. If you think about the opportunity cost of your money, credit cards with 7%+ interest rates will typically cost more than the returns you’ll be getting from investing in the market.

Have any money you need in the short term saved in cash. Investing is for money you don’t need for 5+, 7+ years because you want to be able to wait out dips in the market.

Potentially pay down other debt. This will depend on the interest rate and how comfortable you are with having debt.

BUT just because you don’t have all these boxes checked doesn’t mean you can’t get started. You can set aside some money to learn to invest. That way, by the time you have these boxes checked, you’re comfortable investing and are ready to ramp it up.

I’m sold. Where do I invest?

Good! You have lots of choices when it comes to where you invest your money, but here are a few things to look for when choosing an investment account.

Fees.

All accounts aren’t created equal when it comes to fees. Some charge annual or monthly fees, and even inactivity fees (if your account is inactive for too long). Many accounts also charge commissions to buy and sell investments but you can now find investing accounts that don’t.

With SoFi Invest there are no fees to buy and sell investments. Minimizing fees means more money that stays in your investment account. More money that can potentially grow and compound over time. Open your SoFi Invest account (link here) to get started!

Minimums.

High minimum requirements to open an investment account make it inaccessible for many who are just getting started. Sometimes there’s a fee associated with not meeting a minimum and other times you’re just not able to open the account. I like to support companies who offer low, or better yet, no minimum account requirements to get started. With SoFi Invest there is no minimum requirement.

Investment options.

Investing in low-cost index funds is a great way to diversify our investments. Diversifying is a fancy way of saying not putting all of our investment eggs in one basket. By investing in an ETF or fund, I can be invested in hundreds of different companies across industries and countries just by owning one share.

Diversification can help reduce some investment risk. However, it cannot guarantee profit nor fully protect in a down market.

You want your investment account to have an array of investment options, specifically ETFs or index fund options, especially if that is how you plan to invest.

Learn more about expense ratios and the specifics around investing in this guide.

User Experience

An investing account app or website can make or break your user experience. It affects how easy it is for you to invest, automate, and track your investments. It often determines if we actually enjoy doing it, too.

If you like to invest on your phone, make sure the company you choose has a great app. If you like to invest on your computer, the user interface is still extremely important. User experiences across investing accounts can vary widely. You can read reviews, watch videos of people using the account, and you can even try it for yourself.

I personally am a long-time user and fan of SoFi invest. The app makes it really easy to invest right from your phone and it seamlessly connects to my other accounts. I also love using social invest to see which stocks other people are investing in. Download the app and check it out!

Compare Other Features.

Investment accounts can have cool and unique features to make the investor experience that much more interactive and fun. Here are some awesome features of SoFi Invest:

Social Invest: You can follow other investors to see what they’re investing in and how much that investment makes up of their total portfolio. You can also share what you’re investing in with your friends (on a social feed), ask questions, and talk about investing in general. It’s so important we talk about investing! I love this feature for that reason.

Social investing is meant to be informational and is not advice. Any actions other users take should not be considered as the basis for an investment decision. Investing comes with risks including the risk of loss.

Investing in fractional shares: That means you don’t have to buy an entire share of a security (a.k.a. a tradeable investment) to invest. You can invest with as little as $5 and buy a portion of a share. This makes investing much more accessible to those starting out and you can put exactly how much you want towards any given investment.

Fractional orders are routed to the market immediately. Market conditions may impact execution and price may vary during that time.

IPO investing: IPO stands for initial public offering. This is when a company is first available to be traded by the public (i.e. you and me). Historically, IPOs have only been available to the very wealthy. SoFi is able to allocate a certain number of IPO shares to their investors which I think is just the coolest!

Resources to Support You as An Investor.

Yes, we learn by doing (and that’s why it’s so important to get started), but while we’re learning- by-doing, we might run into a question. We want to choose an investing account that also supports us with resources during our investing journey.

Sign up for an account (you don’t even need to be an investor or member!) and you’ll get access to complimentary financial planning, alerts when your investments are in the news (and any you are following via the watchlist), member events, and the SoFi community.

Ready to get started investing? Open your SoFi Invest account, and you can receive $1000.

The probability of receiving $1000 is 0.028%

Disclosures:

Brokerage and Active investing products offered through SoFi Securities LLC, member FINRA(www.finra.org)/SIPC(www.sipc.org). Advisory services are offered through SoFi Wealth, LLC an SEC-Registered Investment Adviser. Information about SoFi Wealth’s advisory operations, services, and fees is set forth in SoFi Wealth’s current Form ADV Part 2 (Brochure), a copy of which is available upon request and at www.adviserinfo.sec.gov. SoFi Crypto is offered through SoFi Digital Assets, LLC

Exchange Traded Funds (ETFs): Investors should carefully consider the information contained in the prospectus, which contains the Fund’s investment objectives, risks, charges, expenses, and other relevant information. You may obtain a prospectus from the Fund company’s website or by email customer service at investsupport@sofi.com. Please read the prospectus carefully prior to investing.

Shares of ETFs must be bought and sold at market price, which can vary significantly from the Fund’s net asset value (NAV). Investment returns are subject to market volatility and shares may be worth more or less their original value when redeemed. The diversification of an ETF will not protect against loss. An ETF may not achieve its stated investment objective. Rebalancing and other activities within the fund may be subject to tax consequences.

Investing in an Initial Public Offering (IPO) involves substantial risk, including the risk of loss. For a comprehensive discussion of these risks please refer to SoFi Securities’ IPO Risk Disclosure Statement [HYPERLINK https://www.sofi.com/iporisk/].