Money Musings 💭 Mint is going away. Now what?

What you’ll find below:

Reflection: Quizzes are back!

Money Move: Step #2 in the New Year's goal-setting series

You Gotta See This: Your 2024 intentions

Reel of the Week: An important nod to unseen labor

Our quizzes are back!

I love quizzes because they’re a fun way to learn about our money habits and money mindset AND get tailored tips that cater to our individual personalities.

I have two new quizzes for you.

WHICH BUDGETING APP IS RIGHT FOR YOU?

If you use Mint, you've probably heard that the long-time free budgeting app is going away. I've been getting a lot of messages from the Fiscal Femme community asking about the best alternatives. Whether you are switching from Mint or are just looking for a new budgeting solution, I have you covered. Take the quiz to find out which budgeting app is best for you.

WHAT'S YOUR BUDGETING PERSONALITY?

Whether you are a "Budget Despiser" looking to avoid anything that resembles budgeting or a "Budgeting Enthusiast" looking to level up your skills, I have tips that will meet you where you are on your budgeting journey. Take the quiz.

If you enjoy the quizzes, please share them with friends! You can discuss and implement the results together.

MONEY MOVE OF THE WEEK

GOAL SETTING SERIES: STEP #2 - PRIORITIZE YOUR GOALS.

Last week we made a comprehensive list of our goals. Woohoo!

Knowing you, you probably have many goals. While it might feel tempting to work towards them all, I find that we get the best results when we work on 2-5 goals at a time. That way we’re not spreading our funds too thin.

So you are probably wondering, how do I prioritize? What should come first?

Here are some commonly accepted financial guidelines on how to prioritize your money goals.

First and foremost - build up a rainy-day fund. Start with $1,000 or one month's worth of expenses. Ideally, you will want 3-6 months of expenses saved

Next, if you have it, take advantage of your employer’s 401(k) match (hi, free money )

Pay down high-interest credit card debt

Invest for retirement in tax-advantaged accounts like 401(k)s, 403(b)s and IRAs

Save or invest for all other goals. For everything else, it’s a balance of what makes the most financial sense (the interest rate you’re earning or paying) and the urgency or importance to you

Go ahead and rank your goals in order of importance - 1 being the most important and then work your way down the list.

You gotta see this

YOUR NEW YEAR’S INTENTIONS.

Having an intention or money word for the year can give us a north star for our progress. When we are looking for our next money move or inevitably get off track, it can help guide us.

I’m not a fan of vowing to be a completely different person when the New Year hits BUT I am a big fan of setting an intention for what you want more of in 2024.

If you are looking for inspo and/or want to rally around and support this community in their intentions, here are the 2024 financial intentions you all shared. The more popular the word, the bigger the font.

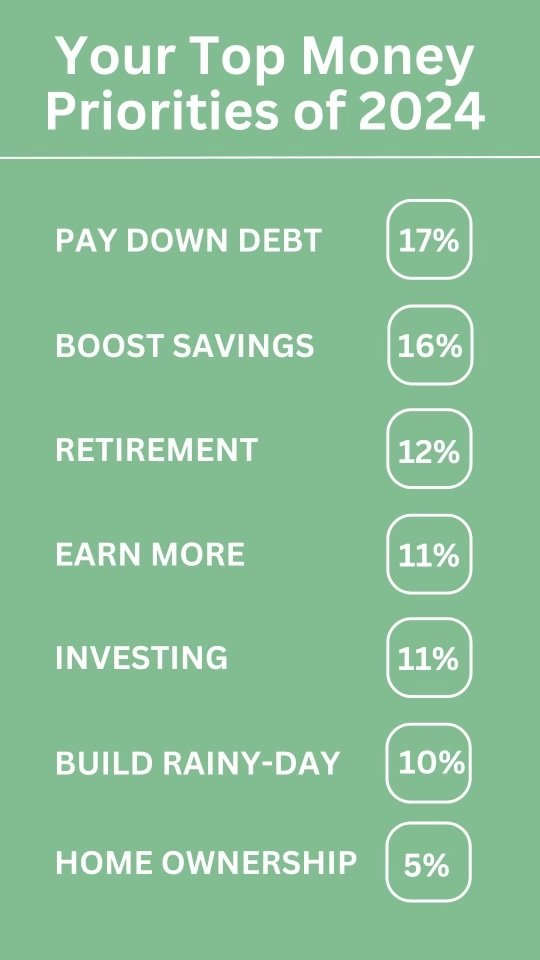

And here are your top money priorities for 2024:

If you didn’t get a chance to share or now have more clarity, I’d love to hear what you’d like your 2024 to look like when it comes to your money. Hit reply and let me know!

your weekly money wins

Here are all the amazing money moves you made this week:

Alex A: Visiting family is always a win - I get to see them, rest and save

Brit L: Paid off credit card, just opened a HY savings account and put $1,500 in, bought a (used) new car

Vanessa S: Of the 10K I have in the bank, I put $5k in a CD for 1 year at 5.6%

Eva: I opened a HYSA with better benefits

Sarah H: First time homeowner in a desirable neighborhood

Jessica T: Meal prepped breakfast, lunch, and dinner for the work week!

Belinda: Building a real estate portfolio for that long-term additional income

Sierra D: $2K away from my goal fund to start investing with! Looking for a badass female fiduciary!

Marina P: I learned to cut and trim my husband's hair and facial hair. I'm so proud of my work

Laura Y: Finished paying off a loan. I have been practicing mindful spending

Elizabeth A: Paid down CC debt!

Katy: At a cheer comp with my kids - packed snacks rather than buying food!

Leah N: I finally paid off a maxed out credit card!

Kelly Meyer: Increased by HYS account contribution from $25 to $100 per pay pd

Connie L: Took time to reset my budget for 2024, paid off a credit card, got 1 paycheck ahead in bills and committed to donating $50 a paycheck to a friend who recently lost her job in the middle of cancer treatment